In spite of the Brexit cloud hovering over the British Isles, the UK economy itself has proven surprisingly resilient.

Low unemployment, a pick-up in wage growth relative to inflation, and expansion in the dominant services sector would all normally be welcomed by investors. Should we view the UK as an attractive place to invest, despite its political woes?

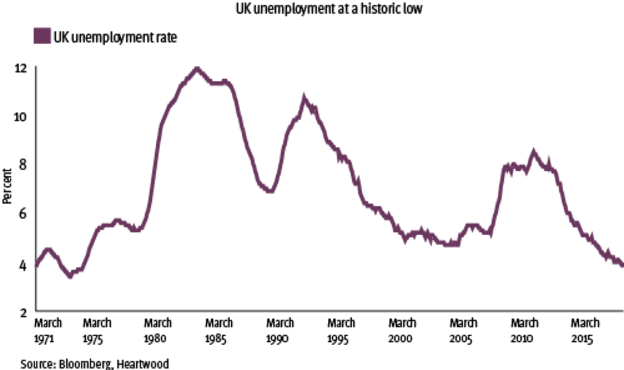

At around 4 per cent, UK unemployment is brushing up against historical lows, and faring much better in this regard than its European counterparts, with the exception of Germany.

Indeed, the UK’s latest jobs market data demonstrated the lowest unemployment rate since the 1970s, at 3.8 per cent.

Meanwhile, on mainland Europe, unemployment in France, Italy and Spain is around 9 per cent, 10 per cent and 15 per cent respectively – although these countries do usually have structurally higher levels of unemployment than the UK.

Key points

- UK unemployment is at historic lows

- In the corporate sector, confidence has stagnated

- Brexit and political turmoil has stalled capital spending plans

Typically, with lower unemployment comes upward pressure on wages, which we are witnessing in the UK today.

In the three-month period to the end of May 2019, total earnings (not including bonuses) rose by 3.6 per cent – the highest since mid-2008.

Low and stable inflation is allowing this wage growth to translate into rising disposable incomes and increased spending power for British consumers – further good news for the economy.

Against this favourable labour market backdrop, UK interest rates have remained benignly low, and are likely to stay that way for the foreseeable future.

We believe that the Bank of England is ultimately looking to increase its store of dry powder in advance of any future recession – that is, raising interest rates so that it has room to cut them again in periods of economic weakness. For now, paralysed under a weight of Brexit uncertainty, it has little choice but to remain on the sidelines.

Over the longer term, we anticipate only gradual and minimal interest rate increases, particularly given the levels of debt in the economy.

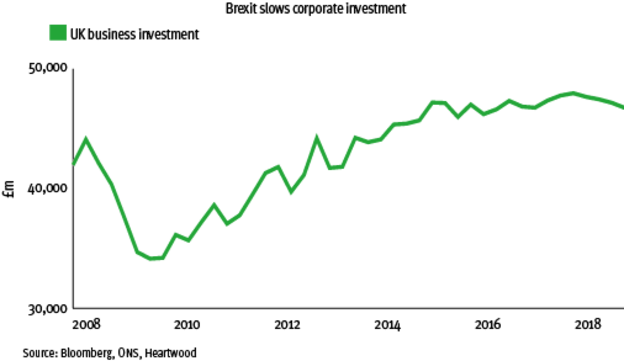

In the corporate sector, confidence and investment have both stagnated – typically a bad sign for economic growth – and more recently this has been evidenced in weaker economic data. However, rather than invest, UK businesses are currently stockpiling high levels of cash.

These excess corporate savings, held tight by nervous businesses, could be released if a Brexit resolution materialises. In turn, this could offer a potentially significant investment boost to the UK economy.

Nonetheless, the outlook for the UK economy is troubled, not least by a lack of clarity on Brexit, as well as the entwined domestic political turmoil.

This week, Conservative party members chose their next party leader, and by extension the new prime minister.

Shortly after, the UK will be back to the negotiating table with the EU, which has previously made clear that it has no intention of reopening the withdrawal agreement. However, a change of leadership in the UK and at the top of key EU institutions may just provide fresh impetus to the discussions.

Given the deeply uncertain political backdrop, the ‘wait and see’ attitude currently being adopted by investors is entirely understandable, as is the mirroring of this unease in the corporate world.

It is worth noting that while businesses stockpiling their cash could well mean a boost to the economy in the future, in today’s terms this means that growth in corporate investment has stalled.

Prolonged uncertainty surrounding Brexit could delay capital spending plans further, without the guarantee that these funds will be released into the economy in the future.

The UK’s dominant economic sector, services, is still in expansionary territory, which is encouraging.

However, in keeping with the global growth picture and concerns around global trade, the UK’s manufacturing sector, albeit much smaller than its services sector, is more troubled, with the latest business surveys showing that it is in contraction.

Further, there are key pockets of weakness in both the retail and real estate sectors, both of which faced an especially challenging 2018.

In addition, the UK has some notable structural problems. Perhaps most conspicuously, it has yet to deal effectively with its debt issues. The UK still sports twin deficits, meaning that the government spends more than it earns (fiscal deficit) and the country imports more than it exports (trade deficit), making it a net borrower overall.

In spite of its challenges, the UK has remained economically robust, and in the future could become an attractive place to invest once more.

The limited political will for a no-deal Brexit outcome is indeed a positive sign for domestically-focused UK assets and the potential for sterling strength ahead.

Nevertheless, UK shares remain markedly unloved by investors, and as a result they are also relatively cheap, appearing good value by virtually all measures, but particularly on price-to-book ratios (the total value of a company’s shares versus the value of its net assets).

Given its out-of-favour status, any change in sentiment could see large capital inflows to the UK stock market and provide a boost to valuations.

However, this simply cannot occur until we have more clarity in UK politics. Without this, and a more certain understanding of our future relationship with Europe, it is hard to justify significant further investment in the UK market in the near term.

By Nikki Howes

Source: FT Adviser